TSMC (Taiwan Semiconductor Manufacturing Company) is critical to the USA for several reasons:

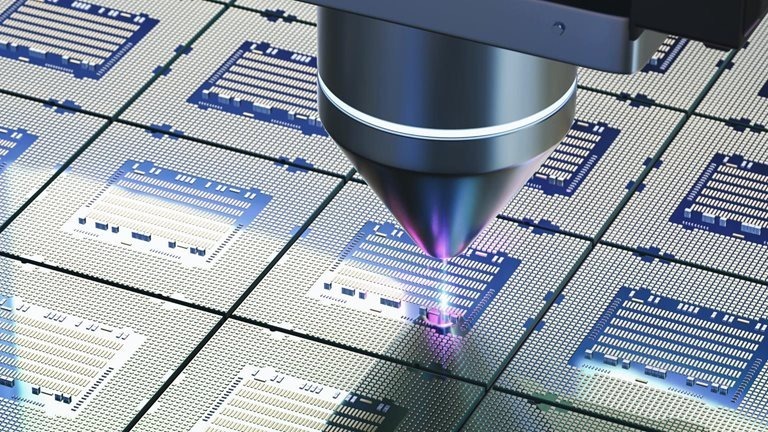

1. Dominance in Semiconductor Manufacturing

TSMC is the world’s leading semiconductor foundry, producing over 90% of the world’s most advanced chips (5nm and below). These chips power everything from smartphones and AI to military and aerospace systems. The U.S. heavily relies on TSMC for cutting-edge technology.

2. National Security & Military Dependence

The U.S. military and defense contractors use advanced semiconductors for missile systems, fighter jets, satellites, and cybersecurity. A disruption in TSMC’s supply could weaken U.S. defense capabilities.

3. Supply Chain Vulnerability & China-Taiwan Tensions

Most of TSMC’s production is based in Taiwan, which is under constant geopolitical threat from China. If China were to disrupt Taiwan’s semiconductor industry, it could cripple the U.S. economy and tech sector.

4. Tech Industry Reliance (Apple, NVIDIA, AMD, Qualcomm, Tesla, etc.)

Many major U.S. companies depend on TSMC for their chip production. For example:

Apple – TSMC makes all of Apple’s A-series and M-series chips.

NVIDIA & AMD – Both rely on TSMC for high-performance GPUs and CPUs.

Tesla – Uses TSMC chips for its AI-powered self-driving technology.

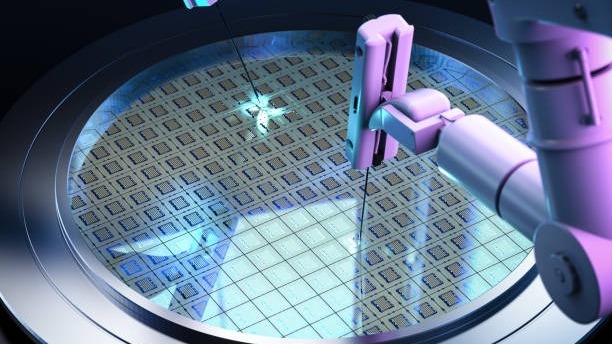

5. The CHIPS Act & U.S. Efforts to Reduce Dependence

Recognizing this reliance, the U.S. has pushed for semiconductor manufacturing domestically. TSMC is building a $40 billion chip plant in Arizona, backed by U.S. government incentives. However, this plant won’t be fully operational until at least 2025-2026, and it won’t produce the most cutting-edge chips initially.

6. Economic & Technological Leadership

Semiconductors drive the global economy and innovation in AI, 5G, quantum computing, and cloud computing. If the U.S. loses access to TSMC’s chips, it risks falling behind China in the global tech race.

Observation

TSMC is a lifeline for the U.S. tech sector and national security. The U.S. is working to diversify its supply chains by bringing more semiconductor production home, but for now, Taiwan and TSMC remain irreplaceable.

The great news is that TSMC is already in the process of expanding into the U.S., with its Arizona chip plants under construction. Here’s the timeline:

TSMC’s Expansion in the U.S.

-

First Arizona Fab (Fab 21) – Operational in 2025

Originally planned for 2024, but delayed to 2025 due to labor shortages and supply chain issues.

Will produce 4nm chips (not the most advanced, but still high-performance).

-

Second Arizona Fab – Operational in 2027-2028

Announced in 2022, this second plant will produce 3nm chips—a more advanced technology.

-

Potential Third U.S. Fab (TBD)

TSMC has hinted at a third fab in the U.S., possibly for 2nm or even more advanced chips, depending on demand and government incentives.

Challenges & Delays

Workforce Issues: TSMC faced difficulties finding skilled U.S. workers and had to bring in Taiwanese engineers.

High Costs: Manufacturing in the U.S. is significantly more expensive than in Taiwan.

Tech Limitations: The most advanced chips (2nm and below) will still likely be made in Taiwan.

Impact on the U.S.

Strengthens domestic semiconductor production to reduce reliance on Taiwan.

Helps U.S. tech companies (Apple, NVIDIA, AMD, etc.) secure chip supply.

Boosts national security by ensuring a local supply of critical chips.

The Future of TSMC: Key Trends and Challenges

TSMC is poised to remain the world’s most important semiconductor manufacturer, but it faces both opportunities and risks as technology, geopolitics, and competition evolve.

1. Maintaining Leadership in Advanced Chip Technology

✅ 2nm Chips (2025-2026): TSMC plans to mass-produce 2nm chips in Taiwan, keeping it ahead of competitors like Intel and Samsung.

✅ Beyond 2nm (1.4nm & Below): Research is already underway for post-2nm nodes, using advanced transistor designs like Gate-All-Around (GAA).

✅ AI & High-Performance Computing: TSMC is doubling down on chips optimized for AI, cloud computing, and quantum computing.

💡 Challenge: As nodes shrink, chipmaking gets more expensive and complex. Only a few customers (Apple, NVIDIA, AMD) can afford cutting-edge chips.

2. Competition with Intel & Samsung

🔺 Intel’s Comeback: The U.S. is heavily investing in Intel’s foundry ambitions, aiming to challenge TSMC by 2027.

🔺 Samsung’s Aggressive Push: Samsung is competing in the 2nm race and investing billions in new fabs.

🔺 China’s Growing Semiconductor Industry: Despite sanctions, China’s SMIC is advancing its chipmaking capabilities.

💡 Challenge: If competitors catch up, TSMC could lose market share or be forced to lower prices.

3. AI, Quantum, and New Chip Technologies

🚀 AI Boom: Demand for AI chips (like NVIDIA’s GPUs) is skyrocketing, benefiting TSMC.

🚀 Quantum Computing: TSMC is researching quantum and post-silicon computing tech.

🚀 Chiplet & 3D Stacking: New architectures (e.g., TSMC’s CoWoS packaging) will revolutionize chip design.

💡 Opportunity: AI and quantum computing will fuel demand for advanced semiconductor manufacturing.

Final Thoughts: TSMC’s Future

✅ Short-Term (2024-2026): TSMC will remain dominant, with 2nm leading the industry.

✅ Mid-Term (2027-2030): Global expansion will reduce reliance on Taiwan, but Intel & Samsung will intensify competition.

✅ Long-Term (Beyond 2030): AI, quantum, and next-gen chip designs will shape the semiconductor landscape.

TSMC is well-positioned, but geopolitical uncertainty and rising competition will challenge its dominance. The next 5-10 years will be crucial for its global strategy.

Add Row

Add Row  Add

Add

Write A Comment